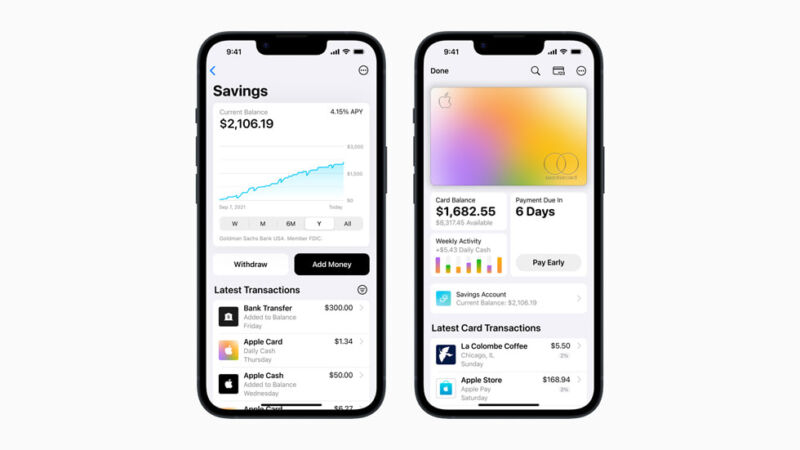

Enlarge / A Savings dashboard in the Wallet app (left) lets users view their savings account balance and how much interest it has earned, among other things. (credit: Apple)

Apple today launched its first savings account, letting Apple Card credit card owners open a high-yield savings account through the company. The service, available through partner Goldman Sachs, offers a 4.15 percent annual percentage yield (APY) and has no minimum balance or deposit requirements or fees.

Apple first previewed the savings account a little over six months ago in October. As per today's announcement, Apple Card users who choose to open a savings account will see cash back earned from Apple Card purchases (up to 3 percent, depending on the merchant) automatically go into their savings account. If they don't like this, they can change where the cash back goes through the Apple Wallet app.

Savings account holders will be able to manage things via a Savings dashboard in the Wallet. The dashboard will let users link another (non-Apple) banking account for fee-less transfers in both directions, as well as conduct transfers to and from an Apple Cash Card.

Read 2 remaining paragraphs | Comments

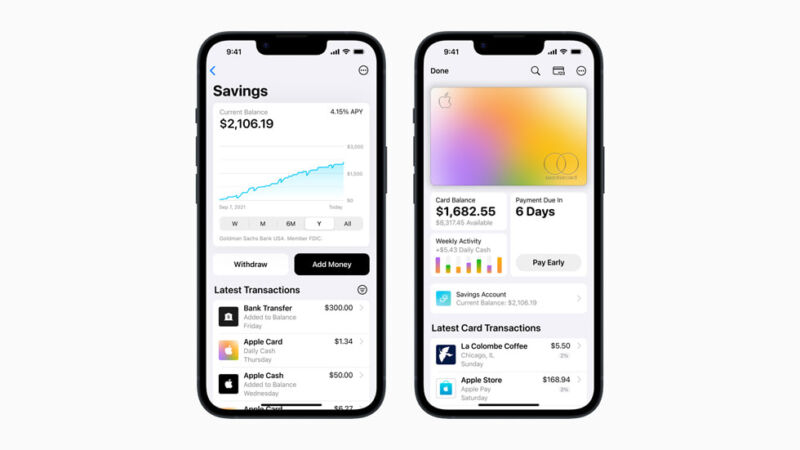

Enlarge / A Savings dashboard in the Wallet app (left) lets users view their savings account balance and how much interest it has earned, among other things. (credit: Apple)

Apple today launched its first savings account, letting Apple Card credit card owners open a high-yield savings account through the company. The service, available through partner Goldman Sachs, offers a 4.15 percent annual percentage yield (APY) and has no minimum balance or deposit requirements or fees.

Apple first previewed the savings account a little over six months ago in October. As per today's announcement, Apple Card users who choose to open a savings account will see cash back earned from Apple Card purchases (up to 3 percent, depending on the merchant) automatically go into their savings account. If they don't like this, they can change where the cash back goes through the Apple Wallet app.

Savings account holders will be able to manage things via a Savings dashboard in the Wallet. The dashboard will let users link another (non-Apple) banking account for fee-less transfers in both directions, as well as conduct transfers to and from an Apple Cash Card.

Read 2 remaining paragraphs | Comments

April 18, 2023 at 12:39AM

Post a Comment